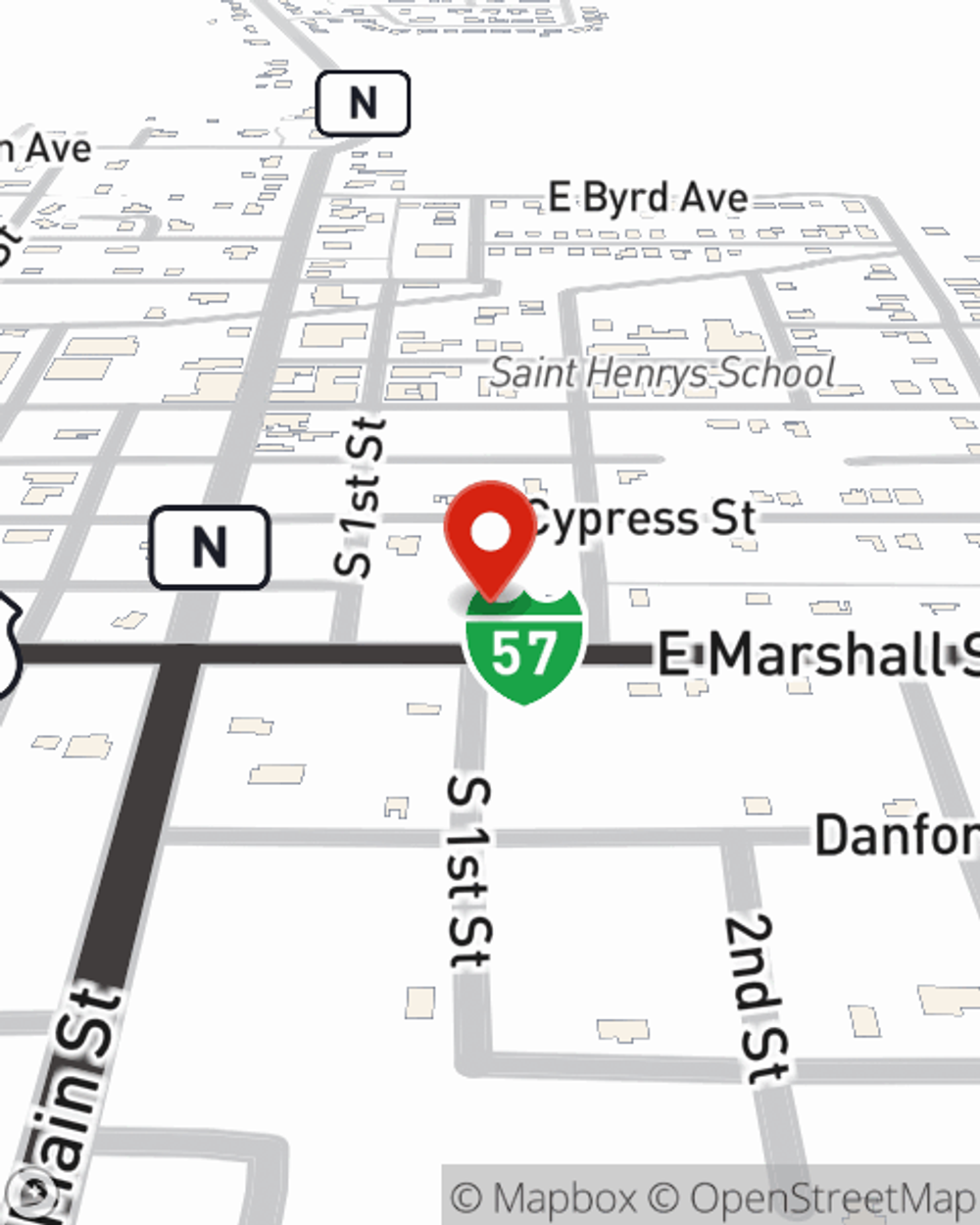

Business Insurance in and around Charleston

Charleston! Look no further for small business insurance.

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Preparation is key for when something unavoidable happens on your business's property like a staff member getting hurt.

Charleston! Look no further for small business insurance.

Almost 100 years of helping small businesses

Get Down To Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Brett Matthews is ready to help you handle the unexpected with reliable coverage for all your business insurance needs. Such individual service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Brett Matthews can help you file your claim. Keep your business protected and growing strong with State Farm!

Don’t let the unknown about your business keep you up at night! Visit State Farm agent Brett Matthews today, and see how you can meet your needs with State Farm small business insurance.

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Brett Matthews

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?